If you’ve ever looked at an affordable housing lottery ad, you’ve seen three letters that go along with every rental price: AMI.

While our eyes might zero in on the numbers and dollar signs, AMI plays a big part in figuring out those rent numbers for each building. It can also play a role in what apartments you’re eligible for, depending on where you fall in the AMI spectrum.

But what the heck is AMI?

AMI stands for Area Median Income and is a number created by the federal government’s Department of Housing and Urban Development, or HUD.

Using data gathered by the Census Bureau, HUD calculates a new AMI every year as a measure of what households in a particular region earn annually. For Brooklynites, that number includes New York City’s other boroughs as well as Westchester, Putnam, and Rockland counties.

There’s no schedule for when the federal government releases new AMIs, but they have historically been unveiled by around March.

In 2017, HUD determined that the AMI for a family of four in the New York City region (which, again, includes counties outside the five boroughs) is $95,400, while an individual resident’s AMI is $66,800.

So where does ‘affordable’ come into play?

This is where things can get confusing. Local agencies and developers then use AMI as a baseline for determining income requirements for affordable housing opportunities.

According to the City of New York, “housing is considered ‘affordable’ when a household spends no more than one-third of its income on rent and bills.” For example, an annual salary for a household of one is $35,000, meaning rent would need to total around $973 a month.

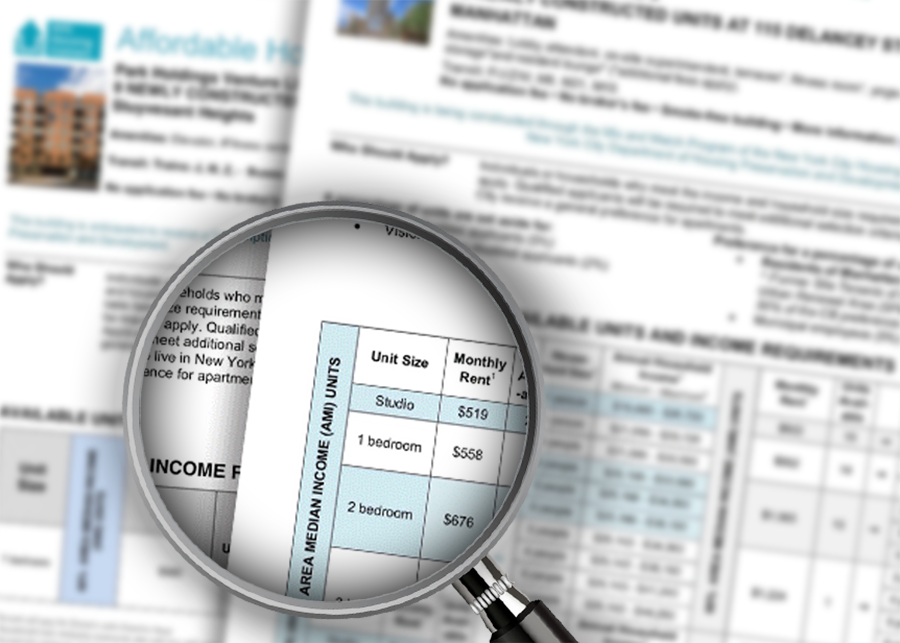

But when it comes to the lottery, different buildings will offer different levels of affordability based on a percentage of AMI. Generally speaking, units marked at or below 80 percent of AMI are typically considered low income, while anything between 80 and 120 percent of AMI is thought of as moderate income.

Some units might be offered at 60% AMI, with a much lower price tag. However, even units listed at 130% AMI are still technically considered affordable.

(Our friends at the Association for Neighborhood and Housing Development have a handy AMI Cheat Sheet you can refer to when you look through affordable housing listings.)

All this means is that “affordable” is relative to your income and household size, as well as other financial obligations — including personal debt and bills.

How does this affect me?

Again, be sure that you can afford not just the rent listed in an ad, but also that you can afford the bills and other obligations. Don’t be discouraged if you can’t find any listings that match your AMI bracket or financial situation. Every new affordable housing listing offers opportunities at different AMI percentages.

You can also keep an eye on efforts to redefine how AMI is used and determined. Some lawmakers want the federal government to exclude counties outside New York City when calculating AMI. A recent New York State bill suggested that AMI should be defined not by region but by ZIP codes.

If you’re struggling with the affordable housing lottery, don’t forget that IMPACCT Brooklyn is a Housing Ambassador with the Department of Housing Preservation and Development. Our staff is ready to walk you through the process and answer all your questions — just email us at affordablehousing@impacctbk.org or visit our Affordable Housing team at 1224 Bedford Avenue!